Additional security is often considered a principal financial thing, yet various families may not understand its benefits. This broad aid intends to illuminate the multiple advantages of catastrophe assurance for families, ensuring that you know its importance in providing financial security and veritable tranquility.

Understanding Life Insurance

Before diving into the benefits, it’s fundamental to grasp additional security. Extra security is an arrangement between an individual and a protection organization. Plan B promises to pay a relegated beneficiary a sum upon the dependable’s downfall. This money-related thing can be divided into two essential sorts: term debacle insurance, which covers a foreordained period, and whole additional security, which incorporates the surefire’s entire life.

1. Financial Security for Dependents

One of the fundamental benefits of calamity insurance is the financial security it provides forwards. In the deplorable instance of a supplier’s not-so-great passing, calamity security can help supersede lost pay. This money-related cushion ensures that families can stay aware of their lifestyle, cover standard expenses, and accumulate financial responsibilities without aggravation.

4. Funeral and Final Expenses

Families regularly achieve various commitments, for instance, contracts, vehicle advances, and Visa changes. Catastrophe assurance can help deal with these surprising commitments after the dependable’s end, holding the load back from falling on getting through family members. This ensures that loved ones are not left with overwhelming money-related responsibilities during a, for the most part, troublesome time.

3. Educational Expenses

For families with youths, the cost of guidance is a tremendous concern. Additional security can help with taking care of educational expenses, ensuring that children can go to the everyday schedule without financial strain. By recollecting a specific total for preparing for the fiasco security technique, guards can guard their children’s future objectives, even in their nonappearance.

4. Funeral and Final Expenses

Dedication administration costs can be amazingly high, often going from $7,000 to $10,000 or more. Catastrophe security can cover these expenses, allowing families to mourn without the extra strain of money-related loads. By organizing funding for these costs through calamity security, families can ensure their loved one’s longings are regarded without causing commitment.

5. Peace of Mind

Understanding that your family is financially protected can give you gigantic genuine serenity. Calamity security licenses individuals to focus on their ongoing lives, understanding that their loved ones will be managed in the event of a fantastic disaster. This internal peacefulness is critical, particularly for fundamental laborers who could feel the substantialness of their family’s financial security lying on their shoulders.

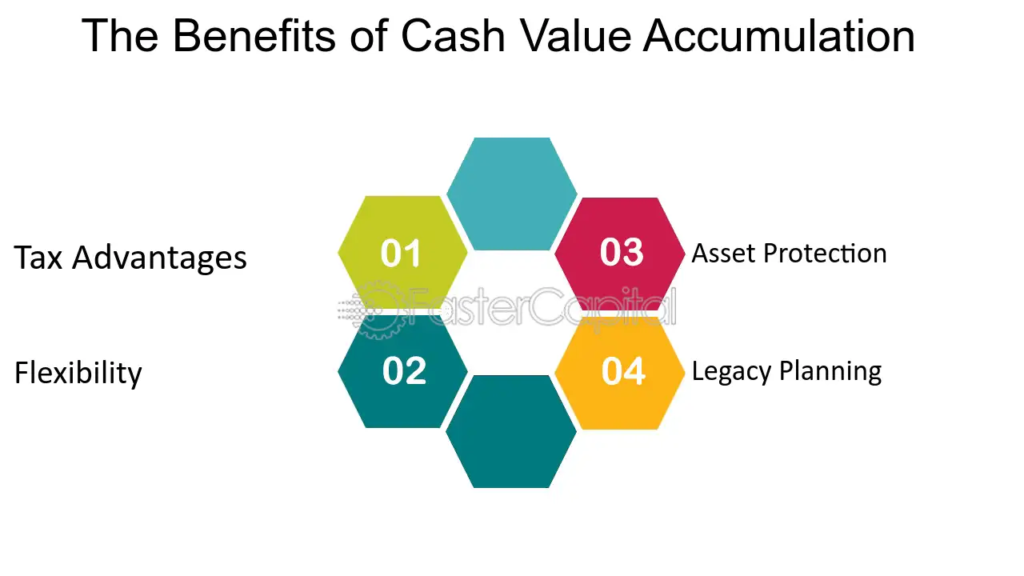

6. Cash Value Accumulation

Specific sorts of additional security, for instance, whole life and far-and-wide debacle insurance, go with a cash regard part. This suggests that a portion of your better portions gathers as cash in regard long term, which can be procured against or taken out. This part can be a significant financial resource for families, providing resources for emergencies, tutoring, or essential purchases.

7. Tax Benefits

Calamity security proceeds are generally not open to individual cost, making them a convincing space-organizing instrument. Beneficiaries get the end benefit freed from charges, ensuring that the arranged aggregate is given to them. Likewise, the cash stored in unambiguous catastrophe security procedures creates charge surrenders, further redesigning the money-related benefits for families.

8. Legacy Building

Additional security can be essential for families wanting to develop a money-related legacy. Individuals can ensure that their loved ones get financial assistance after death by naming beneficiaries. Furthermore, additional security can help trust or unselfish gifts, allowing families to leave a lasting impact past their lifetimes.

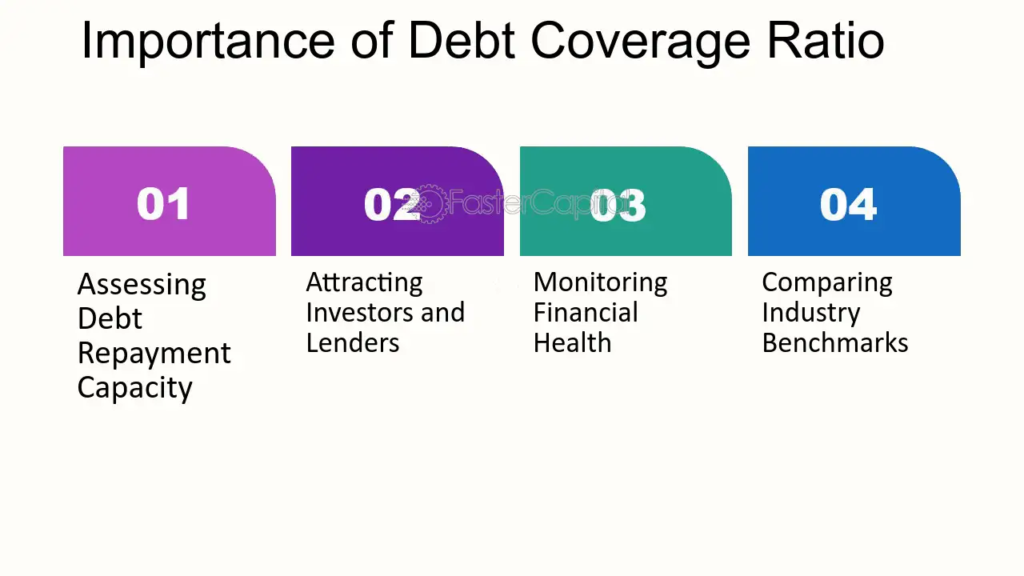

9. Business Protection

For families drawn in with an exclusive organization, additional security can expect a fundamental part in business rationality. A day-to-day existence inclusion procedure on key business visionaries or associates can give the essential resources for covering the setbacks and assurance the business can work effortlessly. This benefit loosens financial security for the family agents and various accomplices related to the company.

10. Adaptability and Flexibility

Catastrophe insurance approaches can be specially crafted to meet every family’s exceptional necessities. This flexibility licenses individuals to pick consideration aggregates, technique types, and additional riders that fit their specific conditions. Whether adding an essential sickness rider or changing the incorporation total as social characteristics change, additional security can conform to the creating necessities of a family.

Conclusion

Fiasco security is a different option from a procedure; an essential financial gadget offers many benefits for families. From giving money-related security and covering uncommon commitments to ensuring informative expenses and offering internal amicability, the advantages of life insurance are expansive. It fills in as a cautious shield, protecting loved ones against startling circumstances and helping families stay aware of their financial robustness.

When considering calamity security, surveying your family’s specific necessities, money-related goals, and other considerations is essential. Chatting with a financial aide or insurance agent can help you make informed decisions and get the right policy that fits your family’s unusual circumstances.

Ultimately, placing assets into life insurance is an interest in your family’s future. You can ensure their success by giving them the financial assistance they require, paying little heed to what life could throw at your head.

FAQs

1. What is life insurance, and why is it important for families?

Life inclusion is an agreement between an individual and a protection office that provides a money-related payout to beneficiaries upon the shielded’s passing. It is enormous for families as it offers financial security, taking care of regular expenses, commitments, and future necessities, ensuring that loved ones are not left in financial wretchedness.

2. How does life insurance provide financial security for dependents?

Fiasco insurance can supersede lost pay if the fundamental supplier fails. This allows families to stay aware of their lifestyle and meet major expenses without financial hardships.

3. Can life insurance help with outstanding debts?

To be sure, life inclusion can be used to deal with exceptional commitments, for instance, contracts, vehicle advances, and Visa changes, holding getting through family members back from securing these financial loads.

4. How does life insurance contribute to children’s education?

Gatekeepers can dole out a piece of the additional security payout for their youths’ tutoring costs, ensuring they can attend the everyday schedule without financial strain.

5. What are the typical funeral costs, and how can life insurance help?

Dedication administration costs can range from $7,000 to $10,000 or more. Life inclusion can cover these expenses, allowing families to regret without worrying about money-related responsibilities during an irksome time.

2 thoughts on “Benefits of Life Insurance for Families”